Making extra principal payments on mortgage calculator

We used the calculator on top the determine the results. The end result of paying every two weeks is youll be paying.

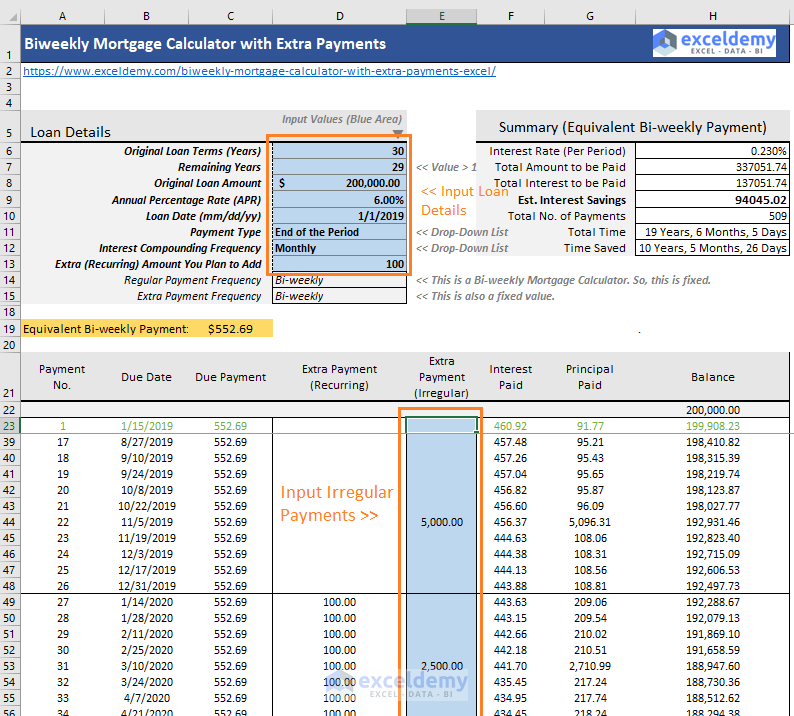

Biweekly Mortgage Calculator With Extra Payments Free Excel Template

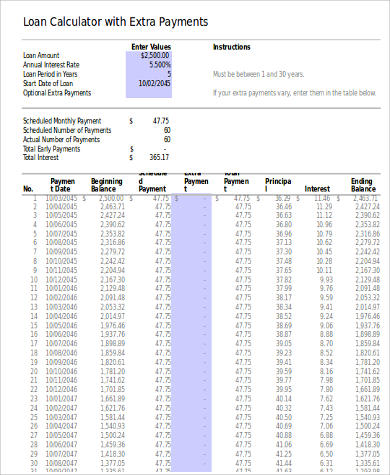

Extra Monthly Principal Calculator.

. Who This Calculator is For. Similar to making biweekly payments you can simply make an extra mortgage payment once a year or pay an additional amount each month 250 more for. Select July 2019 as the beginning extra payment date.

You can p ut your tax return to good use and make an extra mortgage payment. Mortgage Calculator exe file - click the link and immediately run the mortgage calculator. Since creating this spreadsheet Ive created many other calculators that let you include extra mortgage paymentsThe most advanced and flexible one is my Home Mortgage Calculator.

June will actually be the last extra payment Press the View Amortization Schedule button and youll see that your mortgage will be paid in 322 months. Select July 2029 as the ending date. Another technique is to make mortgage payments every two weeks.

Biweekly mortgage calculator with extra payments excel to calculate your mortgage payments and get an amortization. So if youre currently paying 1000 per month in principal and interest payments youd have to pay roughly 1500 per month to cut your loan term. 30-Year Fixed Mortgage Principal Loan Amount.

Making Extra Payments Starting a Few Years In. Mortgage Payoff Calculator 2a Extra Monthly Payments. Hover over yellow icon to make this pop-up disappear.

This bi-weekly pattern is distinct from a bimonthly mortgage payment which may or may not involve extra payments. Total Tax Insurance PMI and Fees. Assess any money that you can foresee needing in the future college tuition a vacation a newused car home repairs.

Making Extra Payments Early. Make extra mortgage payments each year. Please note this calculator only uses the principal and interest PI portion of your mortgage payment.

Mortgage Calculator zip file - download the zip file extract it and install it on your computer. Viewing Your Results Once you have filled out all your information click on the calculate button to see the side-by-side results for your old loan and the loan with extra payments made. Your mortgage payment is defined as your principal and interest payment in this mortgage payoff calculatorWhen you pay extra on your principal balance you reduce the amount of your loan and save money on interest.

Number of Extra Payments. For most people this is more than enough money to cover an extra mortgage payment every year. If youre curious about the benefits of adding an additional principal amount to your monthly payment we encourage you to explore your possibilities with our Extra Monthly Principal Payment Calculator.

Tips for making extra mortgage payments. The net effect is similar to one extra monthly payment 13 per year. Another way to pay down your loan in less time is to make half-monthly payments every 2 weeks.

The average American gets about 2833 in their tax refund according to the IRS. Indicate the number of monthly payments you will be making in the first year. The multiple extra payments can be for 2 or any number up until the loan is paid-in-full.

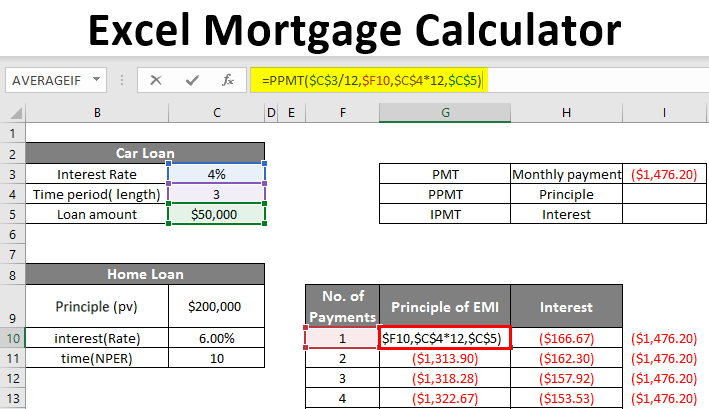

We want to lend a hand in any way we can. Rate and monthly payment. On a 150000 30-year loan with a 4 interest.

Notice there is a big difference between paying twice a month and bi-weekly payments. Extra payments count even after 5 or 7 years into the loan term. If you pay extra on your loan early into the term it means the associated debt is extinguished forever which means a greater share of your future payments will apply toward principal.

You might find that making extra payments on your mortgage can help you repay your loan more quickly and with less interest than making payments according to loans original payment terms. This is the best option if you are in a rush andor only plan on using the calculator today. The program will default to a full year.

Before you begin making extra principal payments on your mortgage its best to consider your overall financial goals. The CUMIPMT function requires the Analysis. Thus most homeowners should plan to adjust the budget as the loan matures.

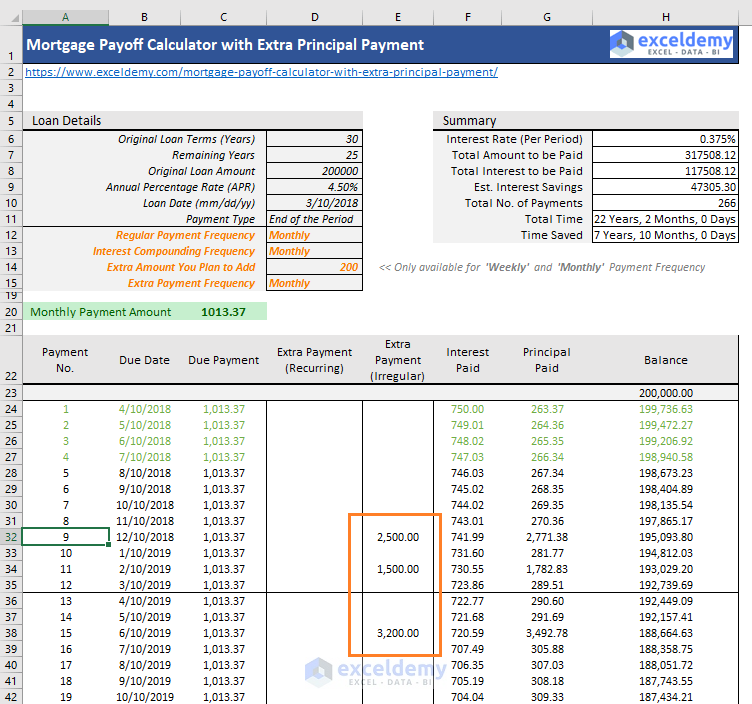

Put simply its a standard mortgage calculator with extra payments built-in so its really easy to use. Pay off your 400000 30-year mortgage in a little over 25 years and save over 36000 in mortgage interest by making 200 additional payments. Monthly for how often extra principal payments will be made.

Who This Calculator is For. If you include property taxes HOA fees PMI or other expenses in your loan payment then you will have to subtract those out. We offer the webs most advanced extra mortgage payment calculator if you would like to track how one-off or recurring extra.

If the first few years have passed its still better to keep making extra payments. Use the Extra Payments Calculator to understand how making additional payments may save you money by decreasing the total amount of interest you pay over the life of your home loan. Consider how long you plan on living in the home.

While analyzing the various methods of making extra mortgage payments consumers should consider their individual financial status. Mortgage Payoff Calculator 2a Extra Monthly Payments. Commit To Making One Extra Payment A Year.

11612 for the extra payment amount. If you own real estate and are considering making extra mortgage payments. Results are only estimates.

Bi-weekly payments help you pay off principal in an accelerated fashion before interest has a chance to compound on it. The first one makes extra payments at the start of the term while the second one starts making extra payments by the sixth year. With a bi-weekly payment youll be be making 26 payments instead of 12 albeit smaller payments.

Keep in mind that you may pay for other costs in your monthly payment such as homeowners insurance property taxes and private mortgage insurance PMI. How Do Biweekly Mortgage Payments Work. A principal-only payment is applied to the amount you initially borrowed the principal not to the interest.

Calculate the difference in total interest paid on a mortgage loan when making additional monthly payments. In that case set the number of extra payments to Unknown When the extra payments are off-schedule the calculator prepares an expanded amortization schedule showing the payment being applied 100 to the principal with interest accruing. In the early years of a longterm loan most of the payment is applied toward interest.

Make sure the payment is principal and interest only. Home buyers can shave years off their loan by paying bi-weekly making extra payments. With a 4 mortgage you might do better to refinance your mortgage into one with a lower interest rate.

Assuming the above scenario youll pay off your 400000 in a little over 25 years and perhaps the best part youll save over 36000 in mortgage interest charges. Even small additional principal payments can help. When you are making payments twice a.

Click yellow icon again to make this pop-up disappear REFINANCE ALERT. Enter your loan information and find out if it makes sense to add additional payments each month. To show you how this works lets compare two 30-year fixed mortgages with the same variables.

Make sure the payment is principal and interest only. You could add 360 extra one-type payments or you could do an extra monthly payment of 50 for 25 years and then an extra monthly payment of 100 for 3 years etc. Enter ONLY the Principal Interest Portion of Your Payments.

For Excel 2003. Four alternatives to paying extra mortgage principal. Make a principal-only payment.

Making an extra payment toward principal directly reduces how much you owe on the loan helping you pay off the initial balance faster. Ultimately significant principal reduction cuts years off your mortgage term. In the example above after one year of additional payments the principal amount would increase to 13700.

This is the best option if you plan on using the calculator many times over the.

Biweekly Mortgage Calculator With Extra Payments Free Excel Template

Extra Payment Calculator Is It The Right Thing To Do

Free 6 Mortgage Payment Calculator Extra Payments In Excel Pdf

Excel Mortgage Calculator How To Calculate Loan Payments In Excel

Extra Payment Calculator Is It The Right Thing To Do

Mortgage With Extra Payments Calculator

Mortgage Payoff Calculator With Extra Principal Payment Free Template

Extra Payment Calculator Is It The Right Thing To Do

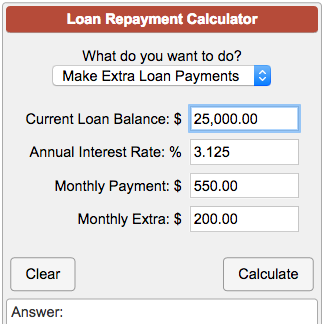

Loan Repayment Calculator

Loan Amortization With Extra Principal Payments Using Microsoft Excel Tvmcalcs Com

Free Interest Only Loan Calculator For Excel

Mortgage Calculator With Extra Payments And Lump Sum Excel Template

Early Mortgage Payoff Calculator Mls Mortgage Amortization Schedule Mortgage Refinance Calculator Mortgage Payoff

Download Our Free Mortgage Payment Calculator With Extra Principal Payment Excel Template Input Only Fe Mortgage Payoff Free Mortgage Calculator Loan Payoff

Extra Payment Mortgage Calculator For Excel

Mortgage Payoff Calculator With Line Of Credit

Loan Amortization With Extra Principal Payments Using Microsoft Excel Tvmcalcs Com